Introduction to this document

Closure report

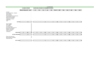

From time to time, businesses choose to close down an office, branch, depot, or separate business (such as a subsidiary or associated company). Closures must be monitored to ensure they are effectively completed and that progress is being made. A closure report summarises for the board the financial elements of controlling such a closure.

Assets and liabilities

The financial elements of controlling a closure include:

- establishing or estimating the book value of all assets and liabilities at the date of closure

- identifying which assets are realisable in cash, and which cease to be assets (e.g. tax may not be recovered if there are no further profits against which to recover them) and estimating the realisable value of those that remain; in most circumstances that will be well below the book value

- identifying and forecasting the costs which will be incurred as a result of the closure, e.g. decommissioning, clearance and professional fees

- providing a phased (month-by month) financial plan for the closure.

A Closure Report gives an instant picture of these elements and can also be used to record the progress of a closure month-by-month. Start with a closure estimate for realising assets, paying off liabilities and requirements for any further funding until closure is finally achieved. You can then phase these figures over the period of the closure.

Narrative

On your closure report include all the information you have about the ability of assets and or additional costs to be incurred, by adding a note as appropriate.

For example, comments about closure assets are:

- customer cash can become difficult to collect in a closure situation

- VAT will not follow normal patterns, but will move with disposals

- prepaid rentals etc. may not be recoverable

- fixed assets tend to lose much of their value (especially office items)

- tax losses may be recoverable against prior period profits

- cash will be needed for removals, decommissioning etc.

And examples of comments about closure liabilities are:

- need to ensure that supplies are available for you to complete items for sale

- additional creditors may arise from the closure process

- accrued items should steadily be eliminated

- liabilities will almost certainly arise in respect of employees

- property may require to be restored to its original condition

- this contingency may or may not be needed.

Document

02 Jan 2013